portability of estate tax exemption 2019

The 2019 Federal estate tax exemption will be 114. The Internal Revenue Service IRS has announced the estate tax exemption and gift tax exemption amounts for 2019.

Estate And Gift Tax Update 2019 Burner Law Group

The Estate Tax Portability Election.

. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. The tax exemption change works with the federal gift and estate tax where the TCJA act doubles the existing exemption from 5 million to 10 million. In the 2010 Tax Act the concept of portability of the unused transfer tax exemption was first introduced in the tax.

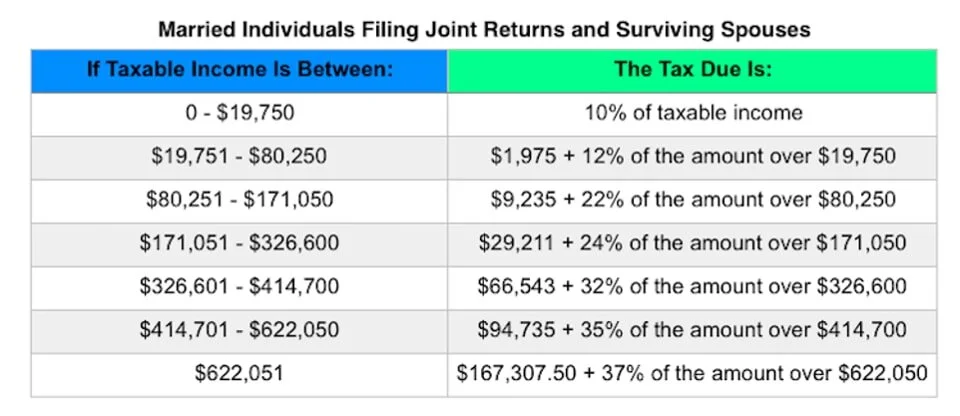

Sylvia passes away in 2022 when the estate tax exemption is 1206 million. Assume that at the time of Jennifers later death the federal estate tax exemption is still 5340000 the estate tax rate is 40 percent and Jennifers estate is still worth 8000000. Resident may not be able to take advantage of estate tax portability.

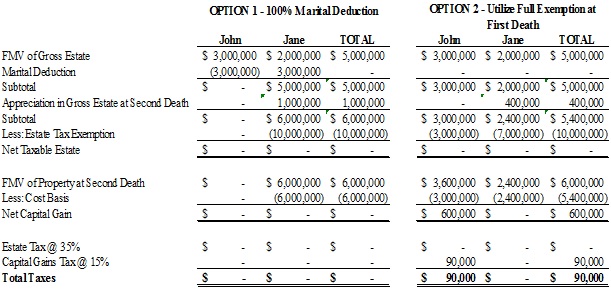

How do I claim estate tax portability. The option of estate tax exemption portability can make a significant difference when it comes to taxation of an estate. If making a portability election a surviving spouse can have an exemption up to 228 million.

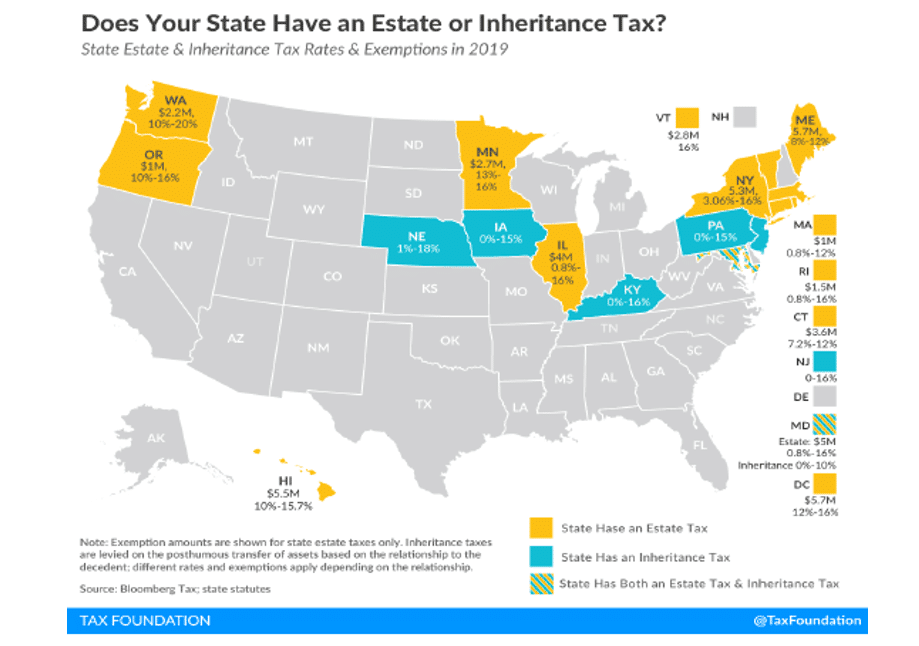

The 2019 federal exemption for gift and estate taxes is 11400000 per person. Some states like Massachusetts have their own estate tax and a. To use portability an estate tax return must be filed.

This exemption stayed in place for. For 2017 the federal amount exempted from death taxes is 549 million and the top federal estate tax rate is 40 percent she said. The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. The estate tax exemption dates back to the Revenue Act of 1916 when the federal government started taxing estates valued at over 50000. The answer is more complicated for New Jerseys.

The estate of a deceased non-citizen cannot elect. We will mail checks to qualified applicants as. This exemption does not entitle any person to a refund of any tax heretofore paid on the transfer of property of the nature.

Unfortunately couples that include a non-citizen non-US. However this exemption is due to end in 2025 unless the law is extended. Estate or estates is exempt from the New Jersey Inheritance Tax.

Portability is a new federal estate tax law provision that allows surviving spouses to use their deceased spouses unused federal estate tax exemption. Foreseeing the inflation the TCJA has. The federal estate tax exemption for married couples is 234M in 2021 2412M in 2022 and portable between spouses.

Portability allows married couples to use two estate tax exemptions and save significant amounts in estate taxes without lifetime planning and without the division of. If one spouse dies before another and doesnt use 100 of hisher estate tax exemption the surviving spouse can use the remaining exemption plus hisher own exemption. You are eligible for a property tax deduction or a property tax credit only if.

In order to elect portability of the decedents unused exclusion amount deceased spousal unused. Sylvias taxable estate is 294 million 15 million less 1206 million resulting in an estate. The Internal Revenue Service announced today.

This set the stage for greater.

Minimize Your State Estate Taxes Through Proper Planning C W O Conner Wealth Advisors Inc Atlanta Georgia

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Irs Raises Estate And Gift Tax Limits For 2019 Postic Bates P C

Estate Gift Tax A Moving Target But No Clawback Is Certain Karp Law Firm

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Estate Planning With Portability In Mind Part Ii The Florida Bar

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

Newly Enhanced Estate Tax Portability Relief Under Revenue Procedure 2022 32 Tax Trusts Estates Law

Portability How It Works For Estate Tax Batson Nolan

Estate Tax Changes Under Recent Tax Acts Wealth Management Cfp Advisors The H Group Inc

Estate Tax In The United States Wikipedia

Mastering Portability Ultimate Estate Planner

To A B Or Not To A B That Is The Question Botti Morison

Overview Of 2019 Estate Exemptions Tax Epilawg

This Strategy Can Double Your Estate Tax Exemption Investmentnews